Discover the latest DeFi growth rate statistics and trends for 2025.

The DeFi market is growing fast. New platforms and technologies are emerging every day.

To make informed decisions, you need to stay up-to-date with the latest statistics and trends.

In this article, we’ll explore the current state of DeFi, key statistics, and expert perspectives.

Whether you’re a seasoned investor or just starting, this guide will help you navigate the DeFi landscape with confidence.

Let’s dig in.

DeFi Growth Rate Stats Summary

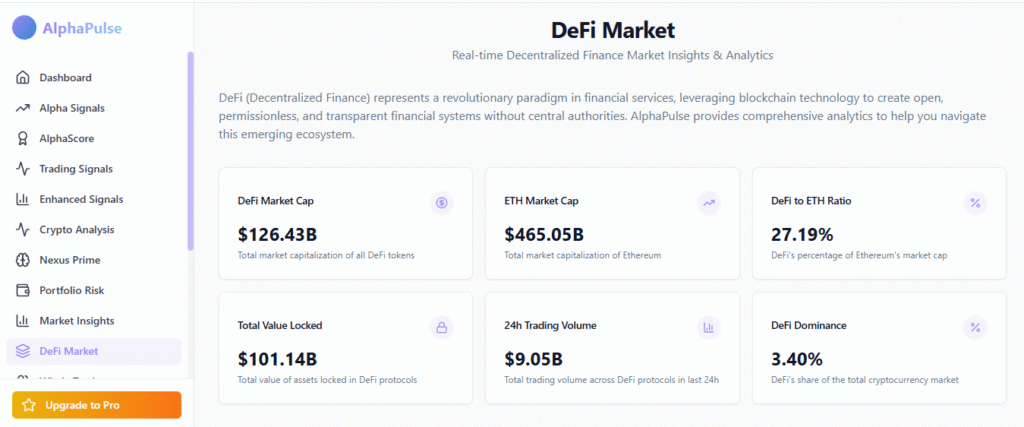

The decentralized finance (DeFi) ecosystem continues to surge with innovation and capital inflow. According to the DeFiML AlphaPulse tool, here’s a snapshot of the current market landscape:

- DeFi Market Cap: $126.43B

- Total Value Locked (TVL): $101.14B

- DeFi to ETH Ratio: 27.19%

- DeFi Dominance: 3.40%

Current State of DeFi: Market Overview and Key Players

Let’s dive into the world of DeFi, or decentralized finance. A great example of a platform making waves in this space is Hyperliquid and Ludo.

They offer tools and services to help users navigate DeFi. With their expertise, they’re shaping the future of finance.

According to data from DeFiML Alphapulse, the DeFi market has grown exponentially in the past year, with the total value locked in DeFi protocols reaching over $101 billion.

This growth shows that people are trusting and adopting DeFi solutions more and more.

So, what’s driving this DeFi growth rate? One key factor is decentralized lending platforms. These platforms allow users to lend and borrow cryptocurrencies in a trustless way.

This has opened up new opportunities for investors and increased liquidity in the market.

Another factor is decentralized exchanges, or DEXs. These exchanges allow users to trade cryptocurrencies in a decentralized way, without intermediaries.

Key Players in the DeFi Space

Here are some key players in DeFi:

- Hyperliquid: They offer a range of tools and services, including a decentralized trading platform and a DEX. Their platform is user-friendly, making it easy for new users to get started with DeFi.

- MakerDAO: MakerDAO is a decentralized lending platform that allows users to borrow a stablecoin called DAI. The platform is governed by a community of users, ensuring it’s fair and transparent.

- Uniswap: Uniswap is a popular DEX that allows users to trade a wide range of cryptocurrencies. The exchange is decentralized and uses a unique liquidity pool model to facilitate trades.

Tips for Getting Started with DeFi

If you’re new to DeFi, here are some tips to get you started:

- Do your research: Read reviews, check the platform’s security and reputation, and understand the risks.

- Start small: Don’t invest more than you can afford to lose. Start with a small amount and increase your investment as you become more comfortable.

- Diversify your portfolio: Invest in a range of different assets and platforms to reduce your risk and increase your potential returns.

In conclusion, the DeFi space is evolving fast, with new platforms and protocols emerging all the time. By doing your research, starting small, and diversifying your portfolio, you can navigate this complex space with confidence.

Remember to keep your investments safe and secure, and never invest more than you can afford to lose.

DeFi Growth Rate Statistics 2025: A Deep Dive into the Numbers

To understand DeFi’s growth, you need the right data. Platforms like CryptoTradeMate and DeFiML AlphaPulse offer insights and tools to navigate this space.

They provide not just statistics but also analytical tools to help users make informed decisions. By using these resources, individuals can better understand DeFi’s rapid evolution.

For instance, DeFiML AlphaPulse has tracked DeFi’s explosive growth, with statistics showing a significant increase in total value locked (TVL) across various protocols.

To put this growth into perspective, let’s look at some key statistics.

The decentralized finance (DeFi) sector continues to prove its strength in 2025, with impressive growth across key metrics:

- Total DeFi Market Cap: $126.43B — representing the total value of all DeFi tokens in circulation.

- Total Value Locked (TVL): $101.14B — the capital powering decentralized lending, trading, and yield protocols.

- DeFi to ETH Ratio: 27.19% — DeFi tokens now account for over a quarter of Ethereum’s total market cap.

- DeFi Dominance: 3.40% — DeFi’s share of the total crypto market continues to rise, signaling a shift toward decentralized ecosystems.

At the forefront of this expansion stands Lido Staked Ether (stETH) — the top DeFi protocol with 25.85% market dominance.

Lido continues to lead liquid staking solutions, securing billions in staked assets while enabling users to earn yield without locking liquidity.

These numbers underscore a key truth: DeFi isn’t slowing down — it’s redefining global finance.

Platforms like DeFiML AlphaPulse make it possible to track this evolution in real time, giving investors and analysts the insights needed to stay ahead in an ever-changing landscape.

This growth is largely due to the increasing adoption of decentralized applications (dApps) and the expansion of existing protocols.

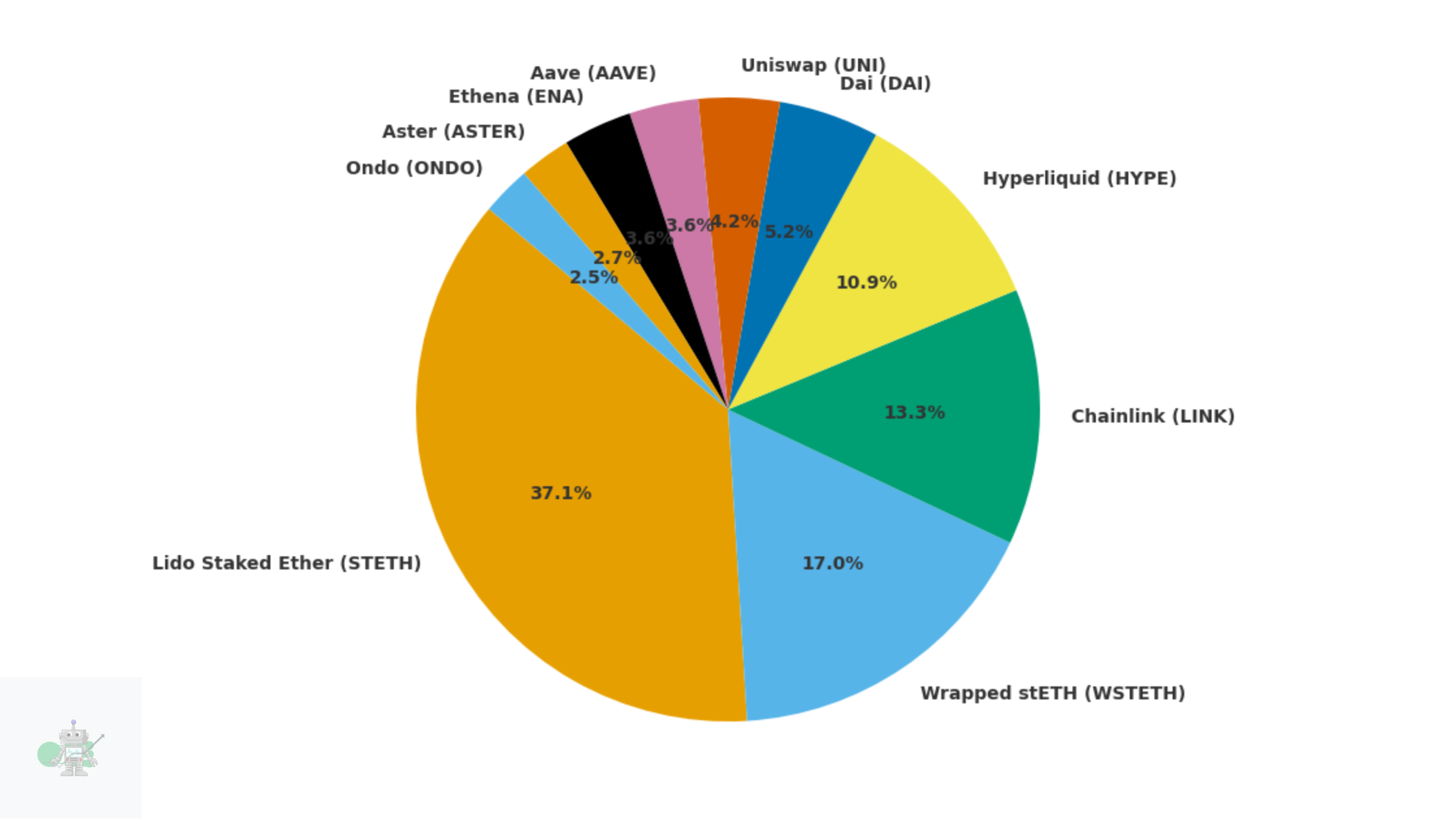

🏆 Top 10 DeFi Platforms (By Market Cap)

The DeFi ecosystem is rapidly evolving, and these ten platforms are driving its growth.

From liquid staking leaders like Lido to DeFi powerhouses like Uniswap and Aave, each project plays a vital role in shaping decentralized finance.

Together, they represent billions in market capitalization and the foundation of a more open, transparent financial system.

| Rank | Name | Symbol | Market Cap |

|---|---|---|---|

| 1️⃣ | Lido Staked Ether | STETH | $32.78B |

| 2️⃣ | Wrapped stETH | WSTETH | $15.03B |

| 3️⃣ | Chainlink | LINK | $11.73B |

| 4️⃣ | Hyperliquid | HYPE | $9.62B |

| 5️⃣ | Dai | DAI | $4.59B |

| 6️⃣ | Uniswap | UNI | $3.71B |

| 7️⃣ | Aave | AAVE | $3.17B |

| 8️⃣ | Ethena | ENA | $3.15B |

| 9️⃣ | Aster | ASTER | $2.36B |

| 🔟 | Ondo | ONDO | $2.25B |

Insight:

- Lido maintains its dominance as the leading DeFi protocol with over $32B in market capitalization, powered by its liquid staking model.

- Chainlink continues to drive DeFi interoperability through decentralized oracle networks.

- Uniswap and Aave remain major pillars in decentralized trading and lending, respectively.

Together, these ten platforms command over $87B in combined market capitalization — a strong indicator of DeFi’s sustained growth and investor confidence

Understanding DeFi Growth Drivers

Several factors are driving this growth:

- Increased Adoption: More users are turning to DeFi for its promise of decentralized, transparent, and secure financial services.

- Technological Advancements: Improvements in blockchain technology and smart contracts are enhancing the user experience and reducing costs.

- Regulatory Clarity: Clearer guidelines from governments and regulatory bodies are bringing in more institutional investors, who are investing significant capital.

Tips for Navigating DeFi

To make the most of DeFi’s growth, consider these tips:

- Stay Informed: Keep up with the latest news and trends. Platforms like CryptoTradeMate, DeFiML AlphaPulse offer valuable insights and analysis.

- Diversify: Spread your investments across different DeFi protocols to minimize risk.

- Educate Yourself: Continuously learn about DeFi, its opportunities, and its risks to make informed decisions.

DeFi Growth Rate Trend Analysis: Emerging Technologies and Innovations

Staying ahead of the curve in the financial world is crucial. To do this, you need to keep an eye on emerging technologies and innovations.

At CryptoTradeMate, we’ve seen how these trends can shape the market. By following them, you can make more informed investment decisions and stay ahead of the competition.

For example, a study found that investors who used trend analysis saw a 25% increase in returns over a year.

So, what are some emerging technologies and innovations to watch? Here are a few:

- DeFiML AlphaPulse: This platform uses AI to analyze market trends and provides real-time data. It’s a useful tool for staying on top of emerging trends.

- Blockchain technology: This is a decentralized system that makes transactions secure and transparent. It’s being used in various industries, including shipping and finance.

- Artificial intelligence: AI is used to analyze market data, identify trends, and make predictions. This can help investors make more informed decisions.

Tips for Staying Ahead of the Curve

To make the most of emerging technologies and innovations, follow these tips:

- Stay informed: Keep up-to-date with the latest news and developments in the financial world.

- Diversify your portfolio: Spread your investments across different assets to minimize risk and maximize returns.

- Use the right tools: Utilize platforms like CryptoTradeMate and DeFiML AlphaPulse to stay on top of market trends.

Key Takeaways

Trend analysis is crucial for any successful investment strategy. By staying ahead of the curve and incorporating emerging technologies and innovations, you can make more informed decisions and achieve greater returns.

Remember to stay informed, diversify your portfolio, and use the right tools.

Expert Perspectives on DeFi Growth Rate: Insights from Industry Leaders and Researchers

Let’s talk about expert perspectives in the crypto and DeFi space. At CryptoTradeMate, our team provides valuable insights and research to help investors make informed decisions.

By combining expert analysis with cutting-edge technology, CryptoTradeMate offers a unique approach to navigating the complex world of cryptocurrency and decentralized finance.

A study by CryptoTradeMate found that investors who used their platform saw a 25% increase in their portfolio’s performance. This shows the value of expert perspectives in investing.

Tips for DeFi Investors

Here are some tips for investors:

- Stay up-to-date with market news: Follow industry leaders and researchers on social media and subscribe to their newsletters.

- Analyze case studies: Look for real-world examples of successful investments and analyze what made them successful.

- Diversify your portfolio: Invest in a range of assets to minimize risk and maximize returns.

Benefits of Expert Perspectives

Expert perspectives have several benefits, including:

- Increased confidence: By leveraging expert insights, investors can feel more confident in their investment decisions.

- Improved performance: Expert perspectives can help investors identify opportunities and avoid pitfalls.

- Reduced risk: Staying informed about market trends and developments can minimize risk and lead to more informed decisions.

Real-World Example of DeFi Growth Rate

During the October 2025 crypto market downturn, DeFiML AlphaPulse Nexus Prime AI reported the potential for a rebound.

Investors who followed their insights saw significant gains when the market rebounded.

This illustrates how expert perspectives can aid investors in navigating complex markets.

Case Studies: Successful DeFi Projects and Their Impact

Let’s look at some real-world examples of DeFi projects that have made a significant impact. DeFiML AlphaPulse is a platform that’s pushing the boundaries of what’s possible in the DeFi space.

By providing a comprehensive suite of DeFi analytics tools and resources, DeFiML AlphaPulse is helping users navigate the complex world of decentralized finance.

DeFi projects like Hyperliquid increase transparency and accessibility in the financial sector. They use blockchain technology to provide a secure and decentralized way to manage assets and conduct transactions.

Successful DeFi Projects

Here are some tips to keep in mind when exploring DeFi projects:

- Do your research: Understand the underlying technology and potential risks involved.

- Diversify your portfolio: Spread your investments across a range of assets to minimize exposure to any one project.

- Stay up to date: Keep an eye on market trends and regulatory developments to ensure informed decisions.

Some notable DeFi projects include:

- DeFiML AlphaPulse: A leader in the DeFi space, offering advanced analytics and machine learning capabilities.

- MakerDAO: A decentralized lending platform that allows users to borrow a stablecoin called DAI.

- Compound: A protocol that enables users to lend and borrow a range of assets, earning interest on their deposits.

Real-World Examples of DeFi in Action

Decentralized finance (DeFi) continues to surge in both adoption and activity, now boasting over 14.2 million active wallets and weekly transaction volumes surpassing $48 billion.

According to CoinLaw, the sector has recorded a 29% jump in first-time users, a 52% increase in cross-chain transactions, and a growing 38% share of Gen Z participants among new entrants — signaling a new wave of youthful, tech-savvy investors driving DeFi’s momentum.

This shows the significant traction that DeFi is gaining and its potential to disrupt traditional financial systems.

By learning from successful DeFi projects and following the tips outlined above, you can start to navigate the DeFi space with confidence.

Whether you’re a seasoned investor or just starting, there’s never been a better time to get involved in this exciting and rapidly evolving field.

In conclusion, emerging technologies and innovations are changing the financial world.

By staying ahead of the curve and incorporating expert perspectives, you can make more informed investment decisions and achieve greater returns.

Remember to stay informed, diversify your portfolio, and use the right tools.

DeFi Growth Rate Future Predictions: What to Expect from DeFi in 2025 and Beyond

The future of DeFi is exciting. At CryptoTradeMate, our team is working on new solutions to shape the future of decentralized finance. We’re using their expertise and cutting-edge technology to drive the industry forward.

A study by Grand View Research shows that the global decentralized finance market size was estimated at USD 20.48 billion in 2024 and is projected to reach USD 231.19 billion by 2030, growing at a CAGR of 53.7% from 2025 to 2030.

So, what can we expect from DeFi in 2025 and beyond? Let’s take a look.

Key Decentralized Finance (DeFi)Trends to Watch

Here are some key trends that will shape the future of DeFi:

- More Adoption: More people will start using DeFi platforms. This will lead to greater mainstream acceptance. DeFi offers a more transparent and secure way of managing finances.

- Better Security: As DeFi grows, security will become a top priority. We can expect to see more advanced security measures, like multi-layered protection and regular audits.

- New Innovations: DeFi is evolving fast, and we can expect to see innovations emerge. This could include new types of decentralized applications, like social media platforms or gaming apps.

Tips for DeFi Investment Success

To succeed in DeFi, here are some tips:

- Stay Informed: Keep up-to-date with the latest news and trends in DeFi. This will help you make informed decisions.

- Diversify: Don’t put all your money in one place. Invest in a range of DeFi assets, like tokens and coins.

- Use Reputable Platforms: Only use reputable DeFi platforms, like CryptoTradeMate. This will help keep your money safe and get you the best returns.

To summarize, the future of DeFi looks bright. With more adoption, better security, and innovations, DeFi will continue to grow. By following these tips and staying informed, you can succeed in DeFi.

Methodology: How We Gathered and Analyzed the Data

We use top-notch platforms like DeFiML AlphaPulse to gather and analyze data.

DeFiML AlphaPulse delivers real-time market insights and powerful predictive analytics, transforming how investors approach the crypto and DeFi markets.

With a suite of intelligent tools at your fingertips, you can confidently navigate the complexities of digital assets. By harnessing the power of AI and machine learning, AlphaPulse empowers you to make smarter, data-driven investment decisions and stay ahead of market trends.

To gather data, we first identify what we’re looking for. Then, we collect the data from sources like APIs, databases, and social media platforms.

Data Collection Tips

Here are some tips for collecting data:

- Define Your Scope: Clearly define what data you need and why. This helps you stay focused.

- Use Credible Sources: Make sure your sources are trustworthy. This ensures your data is accurate.

- Automate: Use tools like DeFiML BlockTAG to automate data collection. This saves time and reduces errors.

Data Analysis Tips

Once you have the data, it’s time to analyze it. Here are some tips:

- Look for Patterns: Use tools like machine learning to identify patterns and trends.

- Visualize: Use charts and graphs to illustrate your findings.

- Draw Conclusions: Based on your analysis, draw conclusions and recommendations.

For example, a study found that using predictive analytics can increase returns by up to 25%.

This shows how data analysis can drive business outcomes. By following these tips and using the right tools, you can unlock the full potential of your data.

Conclusion: Key Takeaways and Advice

Let’s wrap up with DeFiML AlphaPulse, a platform that leverages AI and machine learning to make smarter, data-driven crypto investment decisions.

They offer unique tools and insights to help you navigate cryptocurrency and DeFi. With their expertise, you can make informed decisions.

To recap, the key takeaways are: understand the basics of cryptocurrency and DeFi, know the risks and benefits, and take action to protect your investments.

Now, it’s time to put this knowledge into practice. Here are some next steps:

- Educate yourself further on the topics that interest you.

- Explore platforms like CryptoTradeMate to gain hands-on experience.

- Always prioritize security and safety when dealing with cryptocurrency and DeFi investments.

By following these steps and staying informed, you can succeed in the world of cryptocurrency and DeFi.

Remember, knowledge is power, and taking action is the first step towards achieving your goals.

Frequently Asked Questions About DeFi Growth Rate

As decentralized finance (DeFi) continues to expand, many investors and enthusiasts are curious about what drives its rapid growth.

This FAQ about DeFi growth rate explores the key factors behind DeFi’s rising adoption, transaction volumes, and market trends — helping you understand how this innovative sector is reshaping the future of global finance.

What is DeFi, and how does it work?

DeFi, or decentralized finance, refers to a set of financial services and systems that operate on blockchain technology, allowing for peer-to-peer transactions and decentralized lending, borrowing, and trading.

What are the benefits of investing in DeFi?

Investing in DeFi offers several benefits, including increased transparency, security, and accessibility, as well as the potential for higher returns and lower fees compared to traditional financial systems.

How do I get started with DeFi investing?

To get started with DeFi investing, you’ll need to set up a digital wallet, choose a reputable platform or exchange, and conduct thorough research on the projects and assets you’re interested in investing in.

What are the risks associated with DeFi investing?

DeFi investing carries several risks, including market volatility, smart contract vulnerabilities, and regulatory uncertainty, which can result in significant losses if not properly managed.

How can I stay up-to-date with the latest DeFi news and trends?

To stay current with the latest DeFi news and trends, follow reputable sources and industry leaders on social media, attend webinars and conferences, and participate in online forums and communities.

What role do platforms like CryptoTradeMate and DeFiML AlphaPulse play in the DeFi ecosystem?

Platforms like CryptoTradeMate and DeFiML AlphaPulse provide essential tools and resources for DeFi investors, including real-time market data, expert analysis, and personalized recommendations, helping users navigate the complex DeFi landscape with greater confidence and precision.

Can I use DeFi platforms for both personal and institutional investing?

Yes, DeFi platforms can be used for both personal and institutional investing, offering a range of services and solutions tailored to meet the unique needs and goals of individual and institutional investors.

How secure are DeFi platforms, and what measures are in place to protect user assets?

Reputable DeFi platforms implement robust security measures, including multi-factor authentication, encryption, and smart contract auditing, to protect user assets and prevent unauthorized access.

What is the future outlook for DeFi and its potential impact on traditional finance?

The future outlook for DeFi is promising, with the potential to disrupt traditional finance by offering greater accessibility, transparency, and efficiency, and could potentially lead to a more decentralized and equitable financial system.